14/10/2011 letter to

British Broadcasting Corporation

BBC ComplaintsPO Box 1922

Darlington

DL3 0UR

Dear Sir or Madam,

I am writing to complain about your financial coverage with regard to the banking and monetary system. Ever since the beginning of the financial crisis in 2007/2008 I have watched your coverage, both broadcast and on the internet and observed that you never address the real issues.

The whole problem with the current financial system and the reason the problems are still ongoing is the fact that we have a fiat money system of fractional reserve banking, backstopped by central banking, deposit insurance and legal tender laws.

I have surveyed many people and it is clear to me the public at large doesn't understand the fractional reserve banking system that was codified in law with the legal case of Carr vs. Carr in 1811 when deposit and loan banking were allowed to be merged together. This has been aggravated with the repeal of the United States' Glass Steagal Act of 1933 via the Financial Services Modernisation Act of 1999. Commercial banks are allowed to have money out on loan listed as simultaneously being on deposit and available to customers - akin to a business listing goods payable and good receivable in the same column - something which would be deemed highly illegal for any other business. I have investigated the reserve requirements of British banks and currently there aren't any! The last estimate of their capitalisation I could find was 3.1%, in 1998 - though I suspect that is a lot smaller today given the push for profits and the growth of derivatives since then. Taking the 3.1% figure means that when you deposit £100 in a bank they can lend into existence an additional £3000 and earn interest on it - the modern day equivalent of the goldsmiths of old issuing more gold-claim tickets than gold in the vault.

As is well-documented in the Cobden Centre's recent study of public attitudes to banking...

http://www.cobdencentre.org/?dl_id=67

...most people believe that when they get a loan they are borrowing the savings of other people or institutions, but that is not the case at all. The money essentially springs into existence when they sign the loan agreement. It is legal counterfeiting, plain and simple. The newly created money flows into goods and services and creates price inflation, which is a hidden tax on the holders of money. This inflation tax is the most insidious and devious of all taxes - silent and undetectable to most people. To make matters worse we have legal tender laws to force us to comply with the situation and to stop us choosing to use something else as money if we figure it out.

It is no wonder that the banking system relies on confidence - the money isn't there! When someone withdraws £100 from a bank the loans pyramided on top must be contracted. It is this that can cause bank runs and hence the need for central banking to be the lender of last resort.

When the Which? banking commission asked the public to submit questions I responded - to no avail. The resulting hearings completely ignored this aspect. I marvel at this when fractional reserve banking is the primary factor regarding the soundness of banks for consumer protection purposes. Deposit insurance pay outs would result in debasing the money so that is hardly an acceptable protection.

I've endured various banking hearings; time and again the main issues were ignored. Whenever banking reform is mentioned, one hundred percent of the debate by the government and the financial establishment et al. is about the nuances and minutiae of the regular functions of the banking system and how it affects consumers. Not one single thought is ever given to the system itself from a macro perspective. Deliberately or otherwise, the result is a managed debate. We get to choose which fairly minor adjustments to the system we wish to try out; ultimately it doesn't matter because the system lives to fight another day. Where is the BBC on these issues?

Fredrik. Von Hayek won a Nobel peace prize for his work on interest rates. He showed the price of money plays a very important function, that of sending signals to entrepreneurs. When people have a lot of capital from saving, the cost of borrowing money is low and that just happens to be at a time when people are saving for the future and choosing not to consume today. Entrepreneurs can borrow that capital to start various ventures. As this pool of capital is depleted interest rates rise and cool down the expansion. When savings are scarce and therefore interest rates are high, it just happens to be at the time when people are not saving and are consuming instead. Free market interest rates therefore are a huge factor in moderating the economy, encouraging expansion at the right time and in the right areas and discouraging malinvestment and bubbles or what Alan Greenspan once called "irrational exuberance".

The fact is... one of the primary causes of our woes today is the interference with this valuable signalling mechanism. Attempting to fix the price of capital through money/credit creation is dangerous and morally bankrupt at best. Our problems today could never have occurred with interest rates set by the free market. Perversely, one of the most depressing things now is how capitalism and the free market are frequently blamed for our problems, when actually it is central banking and governments, diametrically opposed to the free market that have brought us to this crisis. I'm not sure we've ever really had true capitalism, what people call capitalism today may be called state-capitalism, crony-capitalism or perhaps even neo-feudalism.

Even with fractional reserve banking, there was a time when private banks were accountable and could be bankrupted by a lack of confidence and a resulting bank run. Rather than outlawing fractional reserve practices, deposit insurance was dreamed up. And so it goes on, ad nauseam.

We have a current ongoing debate about bank charges and aside from the obvious complaints, I've heard the practice defended by the argument that banks used to charge for facilities and services in the past and they have to pay for paper statements etc. Given that we no longer have sight and time deposits, that banks aren't actually safe-keeping our money and the fact that deposits are unwittingly lent to and become a liability of the bank, the idea of charging for banking services is ridiculous. If we had honest money, I would be happy to pay a bank for their services and for keeping my money safe. But sadly, we don't...

I think the goldsmiths of old would marvel at how much larger, bolder and more organised the fraud is today with our layers of system protection from commercial banks right through to the BIS and the IMF. Other countries and civilisations have trodden the same path also and met with a sticky, hyper-inflated end. In fact there have been more than 3500 fiat currencies and they have all failed. The de facto debt default by Richard Nixon in 1971 severed the last tie to discipline and the resulting super currency bubble is beginning to deflate. How are we responding? We are desperately trying to re-inflate it to prop up property prices and to stop the banks from being forced to admit they are completely insolvent. The government talks about people needing a better financial education - they are the worst offenders of all. At least the recession has made people realise that living beyond your means is a bad situation to be in. Now we the public aren't spending, the government is doing it for us. You can't solve debt and inflation with more debt and inflation. How has anyone fallen for the mantra of borrowing our way out of debt through economic growth, which at our level of indebtedness, requires impossible and frankly childlike estimates of growth? Insane! And, in most discussions of blame the Bank of England seems to escape scrutiny far more often than it should. I'd like to see the Bank of England's royal charter revoked and the institution abolished. Wall street and the City of London got drunk...yes, but it was the Bank of England and the Federal Reserve who supplied the alcohol.

Mervyn King himself said...

"Eliminating fractional reserve banking explicitly recognises that the pretence that risk-free deposits can be supported by risky assets is alchemy. If there is a need for genuinely safe deposits the only way they can be provided, while ensuring costs and benefits are fully aligned, is to insist such deposits do not co-exist with risky assets." - Mervyn King - "Banking: From Bagehot to Basel, and Back Again" The Second Bagehot Lecture, Buttonwood Gathering, New York City on Monday 25 October 2010

http://www.bis.org/review/r101028a.pdf?frames=0

Unfortunately, while this is accurate it just isn't widely known. I believe most people would wish to outlaw this practice if they simply knew about it. Private news organisations are free to report on what they wish but I thought the BBC was there to serve the public interest. Discussion of these topics could not fit into that purview more precisely and it would be difficult to find something more newsworthy. Investigative journalism of the high standards the BBC purports to adhere to is meant to question, report and hold to account the various branches of government.

So... this brings me to my complaint specific to the BBC. Imagine my weary disappointment to find that you never, ever cover any of the above.

Robert Peston's guide to banks...

http://www.bbc.co.uk/blogs/bbcthree/2010/03/on-the-money-with-robert-peston.shtml

...completely ignored fractional reserve banking.

Evan Davis' "How a bank's balance sheet works":

http://news.bbc.co.uk/1/hi/business/7826852.stm

...completely ignored fractional reserve banking.

Articles about inflation, such as this one...

http://www.bbc.co.uk/news/business-12196322

...don't bother to explain the connection between interest rates and inflation. They actually mislead and show the causality the wrong way around - as if interest rates are raised to compensate people for high inflation – which is the equivalent of wet streets causing rain... pathetic!

Or in this more recent article about UK inflation hitting 5.2%...

http://www.bbc.co.uk/news/business-15344297

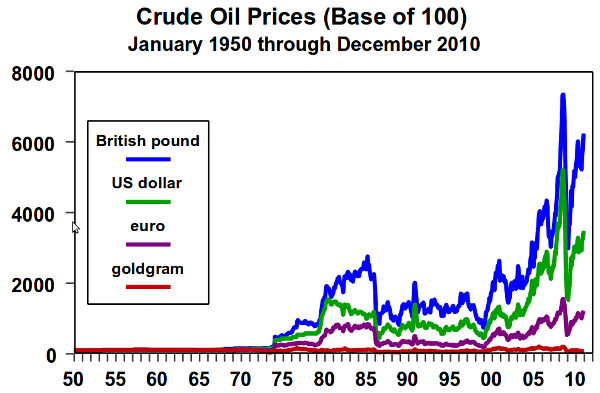

...where Howard Archer's statement that "much will obviously depend on oil price developments" simply went unchallenged as if it is self-evident and then, true to form, a free pass was given for further comments about the CPI reducing in the future for no particular reason at all even when it is against the stated desires of the Bank of England who, due to being boxed into an impossible corner by political expediency, require inflation to reduce the real value of the national debt. When measured in sterling, dollars or euros the price of oil is rising but when measured in gold it has been flat for 60 years as seen in the following chart...

...which clearly proves the oil price rises mostly because of monetary debasement.

I don't see charts like that appearing in your articles even though gold has proven to be the best numéraire since at least 1560, as extensively and conclusively documented in Professor Roy W. Jastram's famous book "The Golden Constant". Your articles are riddled with this backwards understanding of the relationship between inflation and prices and the consequent lack of critique for proponents of this understanding.

There are four main schools of economic thought. The classical economists pretty much agreed with the Austrian school in believing price inflation to be a phenomenon predominantly caused by monetary inflation. Milton Friedman, the most well-known Monetarist economist famously said "Inflation is always and everywhere a monetary phenomenon" and the Keynesian school are renowned for believing price inflation is caused by increasing the money stock through central banking procedures; indeed, their whole premise is to increase employment by reducing wages in real terms in a way undetected by workers or those who have what John Maynard Keynes himself termed "money illusion". All four of the most important economic schools of the last 100 years disagree with the (lack of) understanding your articles disseminate. Fancy that - journalism that actually reduces the readers' understanding of an issue!

Am I seriously supposed to believe that your economics and financial journalists don't know the nature and nuances of the system they report on? They are either wilfully ignorant or are deliberately neglecting these crucial and undeniable facts. As a licence payer, I'd like to know which it is?

Yours faithfully,

[NAME REMOVED]BBC Reply - 13 December 2011

PDF of actual letter13 December 2011

Dear [NAME REMOVED]

Reference: CAS-1119309

Many thanks for your letter.

My colleague Robert Peston and the rest of the team are well aware of the criticisms of fractional reserve banking.

You make a number of important points about the banking system, many of which were reflected in Robert's documentary "Britain's Banks: Too Big To Save?" broadcast earlier this year.

Regards

Tim WeberBusiness and technology editor

BBC News interactive

My Reply - 4th January 2012

Tim Weber

BBC News interactive

PO Box 1922

Darlington

DL3 0UR

Dear Mr Weber,

Thank you for your woefully inadequate response to my letter dated 14th October 2011. I find it remarkable that it took two months to formulate such a sparse letter, particularly in reply to such a considered and discursive one. I suspect it took some contemplation on your part to reply without actually saying anything; I must admit to some perverse, wry pleasure when I realised what I thought was a compliments slip was actually your reply!

The crux of my letter was to enquire if your “journalists” knew about the issues I highlighted in my original complaint and to ask why many things are ignored in your articles and why some are nonsensical.

I personally consider the inaccuracies a deliberate misrepresentation of the facts but however implausible I did seek a noble admission of ignorance.

However, Occam's razor prevails once again and I appreciate your candour in admitting as much!

The list of content driving value for the licence fee shrinks ever smaller...

Yours sincerely,

[NAME REMOVED]