06/03/2012 letter to

The Royal Institute of International Affairs

In reponse to a paper they published called: Gold and the International Monetary System

Paper Summary

Link directly to report

F.A.O André Astrow

Chatham House Gold Taskforce

The Royal Institute of International Affairs

Chatham House

10 St James's Square

London SW1Y 4LE

Dear André Astrow,

I recently read your report "Gold and the International Monetary System" and I felt compelled to write to you about it.

I am a amateur student of monetary history and economics with a particular focus on gold. Your report makes for extraordinarily frustrating reading. The whole thing is predicated on a modern view of economics where the free market must be subservient to government. The financial criss we are currently enduring has shown, if nothing else, that "modern" views of economic thinking are misguided and, I believe, wrong.

There are a number of problems with your report. Some of your findings are inconsistent with the facts and perhaps more troubling, the report is imbued with common and annoyingly persistent fallacies, that surface at various points in the report. I will try to tackle these in some semblance of order.

Fallacy 1: Gold is not stable

"In fact, a serious drawback is that a gold anchor can become particularly unstable precisely when a stabilizing force is needed most. As gold prices tend to rise when inflationary expectations and/or other risks in the fiat monetary system increase".

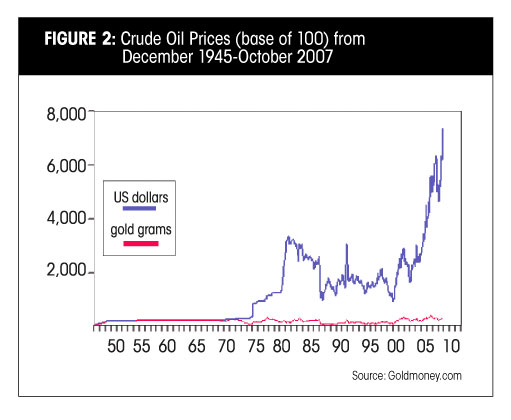

Against the backdrop of elastic, fiat currency, this sentence is striking and incredible! Gold is not stable!? The truth could not be more different. As proven in Professor Roy Jastram's book "The Golden Constant", gold is astonishingly, yet not surprisingly, stable. Just look at the following chart...

Clearly, it is not gold that is fluctuating by such a large amount, it is the value of inconvertible fiduciary media. Newton's gold standard lasted nearly 230 years with stable prices. History is replete with examples from Byzantium to the modern US experience, pre-1913.

Fallacy 2: Deflation caused by reverting at the wrong parity

Again, more misconceptions. Gold at the wrong parity is a stranglehold, but it does not cause depressions. It is the government strangling the gold “price” and defining its “price” that causes depressions. It is credit expansion and fractional reserve banking that are to blame. In a system of a fixed money supply, the price of gold would change by its purchasing power relative to goods and services. Gold has been shown over time to promote a mild deflationary bias which is actually a very positive thing. It is only a strict adherence to the faulty ideology of inflation being desirable that blinds the authors to this fact. Gold, by itself and without government interference does not cause the wild and steep deflations associated with economic malady. Its slowly increasing purchasing power over time encourages production and saving and the more careful management of scarce resources. The idea that debt would become more burdensome is also nonsense; the free market would adjust quite happily. Lenders would know they would be being paid back money likely to be worth more and that would be factored into interest rates, real ones anyhow.

In fact, people are being denied the full benefits of improved productivity from technology. The productivity gain and consequent benefit to individuals is being creamed off the top by inflationary policies. It is morally repugnant and, when explained, seems obvious to all but those with expensive educations. Nevertheless, even from a cold, hard scientific point of view that does not care about the moral dimension, inflationary policies have never worked, not once in thousands of years of history. As Voltaire so eloquently said...

"Paper money eventually returns to its intrinsic value: zero."

There hasn't been one victory I know of on the side of paper currencies and yet we continue to ignore history. The sad truth is, it doesn't work but since the few benefit at the expense of the many while the system limps along, it isn't seriously and honestly questioned.

Fallacy 3: Not enough gold

Yet another fallacy surfaces with this quote:

"Has the handling of the credit question been prejudiced by gold shortage or gold maldistribution?' and ‘has the credit question been mishandled despite adequate gold?"

Shortage? Adequate Gold? Even basic economics shows that any amount of gold will suffice as money, particularly in the digital world. All that must be done is not to control the price. The only reason anyone has sought to control the price is simply to prevent the market carrying out economic law and bringing the supply of gold and the supply of ever increasing paper tickets into equilibrium, preventing the free lunch the currency controllers think they can obtain.

Fallacy 4: Government controlled currency is necessary

Your whole article is built on a foundation and belief in the status quo; that government and central banks need to control the currency. It is their control and horrendous mismanagement that has proven to be the problem with the whole thing. Aside from the clear fact that the free market would never, ever freely choose irredeemable paper money there is no reason why it can't work if it were managed properly; unfortunately this has never happened and it's further complicated by fractional reserve banking or to put it in more vulgar but accurate parlance - theft.

"To play an even more formal role as a hedge or safe haven it would be imperative that gold did not impose unacceptable constraints on national economic policies."

To whom exactly is it unacceptable? I contend that actually the constraints are wholly desirable, and government interference through national economic policies are unacceptable to free people.

"The power of central banks to set or manipulate the world gold price has also been eroded as the private gold market has grown relative to the amount of gold at the disposal of central banks."

...and...

"Being unable to control the gold price in private markets, central banks cannot ensure a fixed price relationship between gold and a given currency."

The whole premise of central banks controlling the price of gold is bizarre and nonsensical. It is precisely because you don't control the price that makes a gold standard work. Prices relative to gold must be free to move both up and down. It is government and central bank meddling that has destroyed the economy and the currency. Currencies needs to be representations of weight, not nominal amounts that provide governments opportunities to debase in ways not too dissimilar from coin clipping or smelting with lesser metals. Your paper alludes to the use of swaps and leases to control the price. It can't work and won't work, not in the long term - just as the London gold pool failed.

Gold is the market's money. As mentioned earlier, fiat currency would never have been chosen - it always and everywhere evolves as a bait and switch. If fiat currency is so good, why do we have capital gains tax on other mediums of exchange and legal tender laws? Legal tender laws are there to force us to use government controlled currency. Why do the public have to be coerced and/or forced to use government controlled money? The answer is clear... it is inferior and anyone with common sense would choose not to use it. We're being forced to comply with our own robbery.

The platform for failure in our modern system is the controlling of interest rates. Interest rates are the nerves of capitalism, sending signals to savers and borrowers and coordinating capital over time. Attempting to control them via central banking, destroys the signalling mechanism and the vitality of the system. The problem with Keynesianism and monetarism is that they seem to completely ignore capital structure. Every unit of spending is apparently uniform and equally beneficial - they miss the point that manipulating the signals causes people to engage in malinvestments that damage the economy down the road. The Austrian school deeply understands that distinction.

This platform of failure has four legs attempting to prop it up.

- Fractional reserve lending

- Fiat currency

- Legal tender laws

- Deposit insurance

The causality runs something like this...

- Fractional reserve lending is engaged in and it fails...

- Central banks are instituted to save the system from bank runs...

- Uniquely positioned to affect the whole system, central banks manage the price of money which usually means debasement to artificially hold down interest rates.

- Governments then step in to stop people escaping this monetary control, they enact legal tender laws and taxes on competing monies.

- Even that doesn't work so finally the government guarantees all deposits, which is a pretence; the people will get their currency but it may not be worth very much.

At each stage, instead of outlawing the practice, the system is protected. The same is true today. Your proposals are not much different - tweak the system to keep it limping along. Whenever banking reform is mentioned, almost one hundred percent of the debate by the government and the financial establishment et al. is about the nuances and minutiae of the regular functions of the banking system and how it affects consumers. Very rarely is a single thought ever given to the system itself from a macro perspective. Deliberately or otherwise, the result is a managed debate. We get to choose which fairly minor adjustments to the system we wish to try out; ultimately it doesn't matter because the system lives to fight another day. How disappointing and upsetting then, to find a discussion of this nature being addressed, but being handled by a group whose views turn out to be the epitome of academic indoctrination as I see it. Conventional wisdom in modern economics seems to view the economy as an equation to be solved, an equation that can be balanced from either side, with no thought to causality or the individual choices that make the market work.

Austrian school economist Detlev Schlicter, referring specifically to your report, described it as "thinking inside the box" and I could not have found a phrase that summed it up more perfectly. If you have not already done so, I urge you to read his critique of your report.

http://papermoneycollapse.com/2012/03/thinking-inside-the-box-chatham-house-on-gold/

I've tried to discuss areas he hasn't focused as much on but we do overlap. However, his insights cut right to the heart of the matter.

The key to a working monetary system is honesty and equality and it must not favour any special group. Every time one evolves freely, it is clapped in irons and the life is slowly squeezed out of it. As the prisoner dies its captors and tormentors claim it is dying of natural causes. How can your group not see that?

Best regards,

[NAME REMOVED]